The housing market headlines often focus on prices and interest rates, but a major part of the story is demographic. Who is buying, who is selling, and why has shifted in meaningful ways—and those shifts matter if you are thinking about making a move.

Using the latest insights from the 2025 National Association of REALTORS® Profile of Home Buyers and Sellers, here is what we know about this key factor.

Home Sellers in 2025: Older, Established, and Intentional

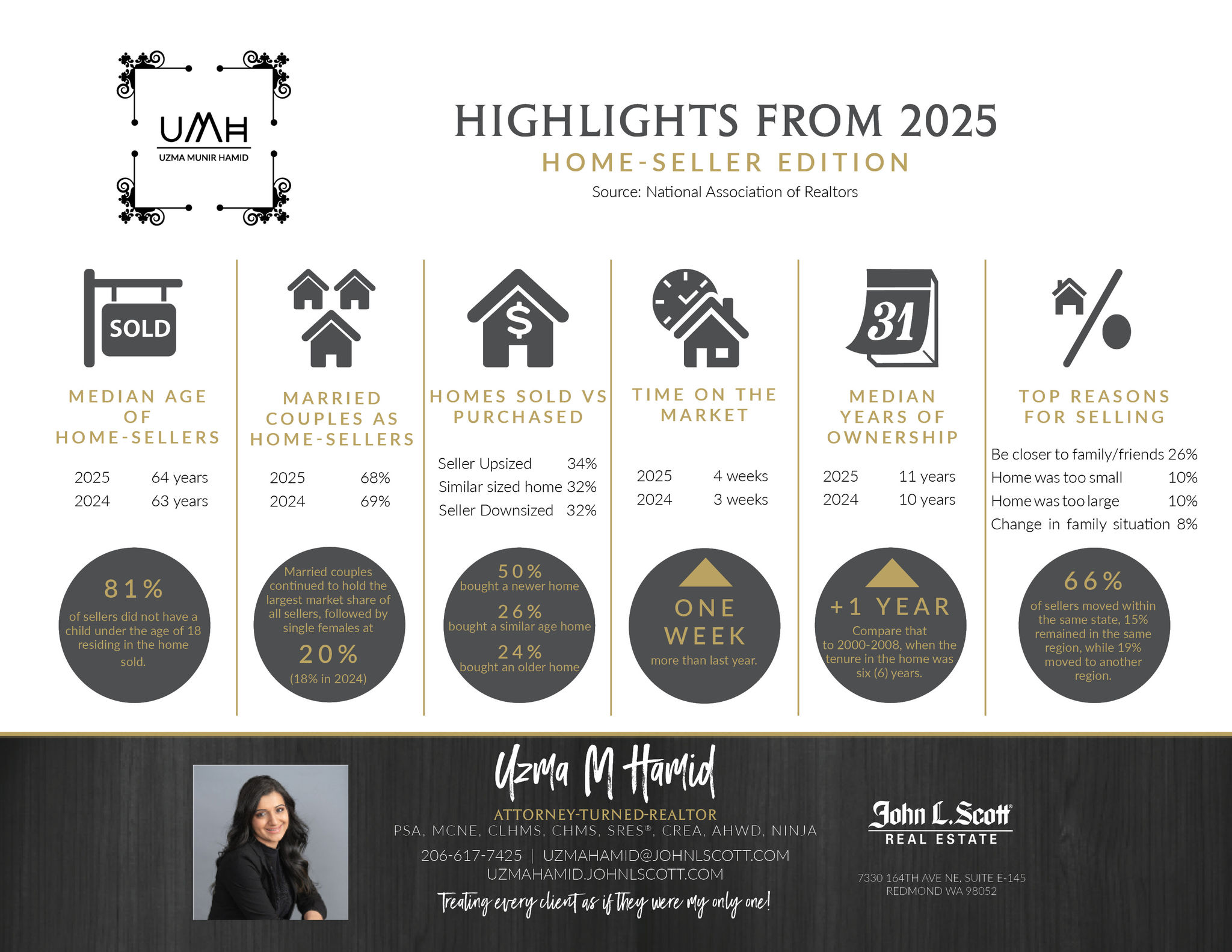

The typical home seller in 2025 was 64 years old, the oldest median age ever recorded. Even more telling? Sellers owned their homes for a median of 11 years before selling—also a record. That is nearly double the six-year median ownership seen from 2000 to 2008.

Also, it wasn’t a market flooded with rushed sellers. These were homeowners who had built equity, waited intentionally, and were making thoughtful moves.

Married couples continued to make up the largest segment of the seller pool (followed by single women), and more than four out of five didn’t have children under 18 at home. That aligned with the top reasons people sold in 2025: moving closer to friends or family; realizing their home was no longer the right size (too big or small); change in family situations (death, divorce); or neighborhood became less desirable.

Homes continued to sell efficiently, with a median time on market of four weeks. While that was longer than the two-week median in 2023 and three weeks in 2024, it reflects normalization rather than weakness.

After selling, outcomes were evenly split. Roughly a third of sellers upsized, a third downsized, and a third bought something similar in size. About half moved into a newer home, while the rest chose homes of similar or older age. Two-thirds stayed in the same state, and about one in five moved to a different region entirely.

In short: sellers are deliberate, flexible, and often financially strong.

Buyers in 2025: A Widening Gap Between First-Time and Repeat Buyers

On the buyer side, the story became more polarized.

First-time buyers fell to just 21% of all buyers in 2025, the lowest share ever recorded. To put that in perspective, before 2008, first-time buyers typically made up around 40% of the market.

They are also older than ever. The median age of a first-time buyer is now 40, up sharply from just a few years ago. High rent, student loans, and childcare costs are the biggest barriers to saving, and those who do make it into the market are relying primarily on personal savings and financial assets—not family gifts like in years past. Their typical down payment is now 10%, the highest level since the late 1980s.

Repeat buyers, on the other hand, are entering the market with confidence and leverage. The median age of repeat buyers reached 62, and many are using years of accumulated equity to their advantage. The median down payment for repeat buyers is 23%, and nearly 30% are paying all cash.

This equity gap explains much of today’s competition—and why some buyers feel like the odds are stacked against them.

As for reasons to purchase, lifestyle outweighs logistics across all buyers.

Desire to own remained the top motivator, followed closely by convenience (proximity to friends, family and work). Quality of the neighborhood was also a priority; however, it is interesting to note that proximity to work (within the "convenience" bracket) continued to decline in importance, even as return-to-office policies increase. Only 24% of buyers have children under 18, another record low, reflecting both demographic shifts and affordability pressures.

Financing patterns are changing too. In 2025, 70% of buyers financed their purchase, down from 74% in 2024 and 80% in 2023.

What This Means for You

This is not a chaotic market—it’s a selective one.

Sellers who understand pricing, preparation, and timing are still seeing strong results. Buyers who succeed are doing so with clear strategies, realistic expectations, and strong guidance.

Whether you are thinking about selling after years of ownership, buying again using equity, or trying to break in as a first-time buyer, the biggest advantage right now is context—knowing where you fit into today’s market and how to move accordingly.

Thinking About Selling?

If you have owned your home for years and are wondering whether now is the right time, a data-driven, personalized strategy matters more than ever. Let’s talk through your goals, timing, and equity—and decide if selling now truly works in your favor.

Thinking About Buying?

Whether you are buying your first home or your next one, today’s market rewards preparation and smart positioning. I will help you build a plan that fits your life, your finances, and today’s realities—so you are not just competing, but winning.

If you want to talk through what the aforementioned trends mean for you specifically, I am always happy to start with a conversation.